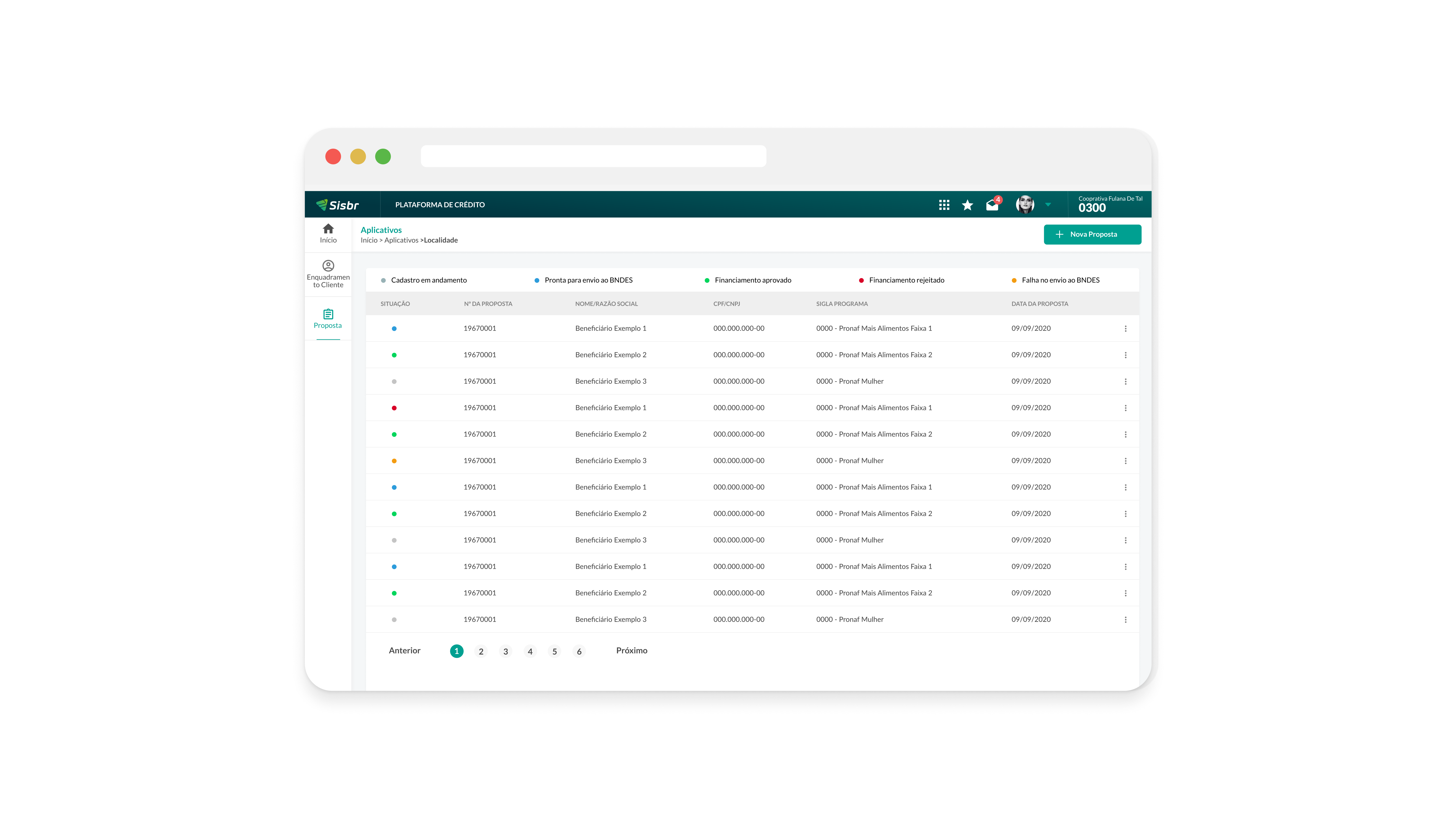

It is an application that centralizes all applications for cooperatives; each squad within Sicoob is mainly responsible for an application, such as Bank accounts, cards, and Financing. The 2.0 application uses a technology that Adobe would no longer support, FLEX, so the company decided to invest in a new front-end technology, in this case, Angular.

UX chapter Leader

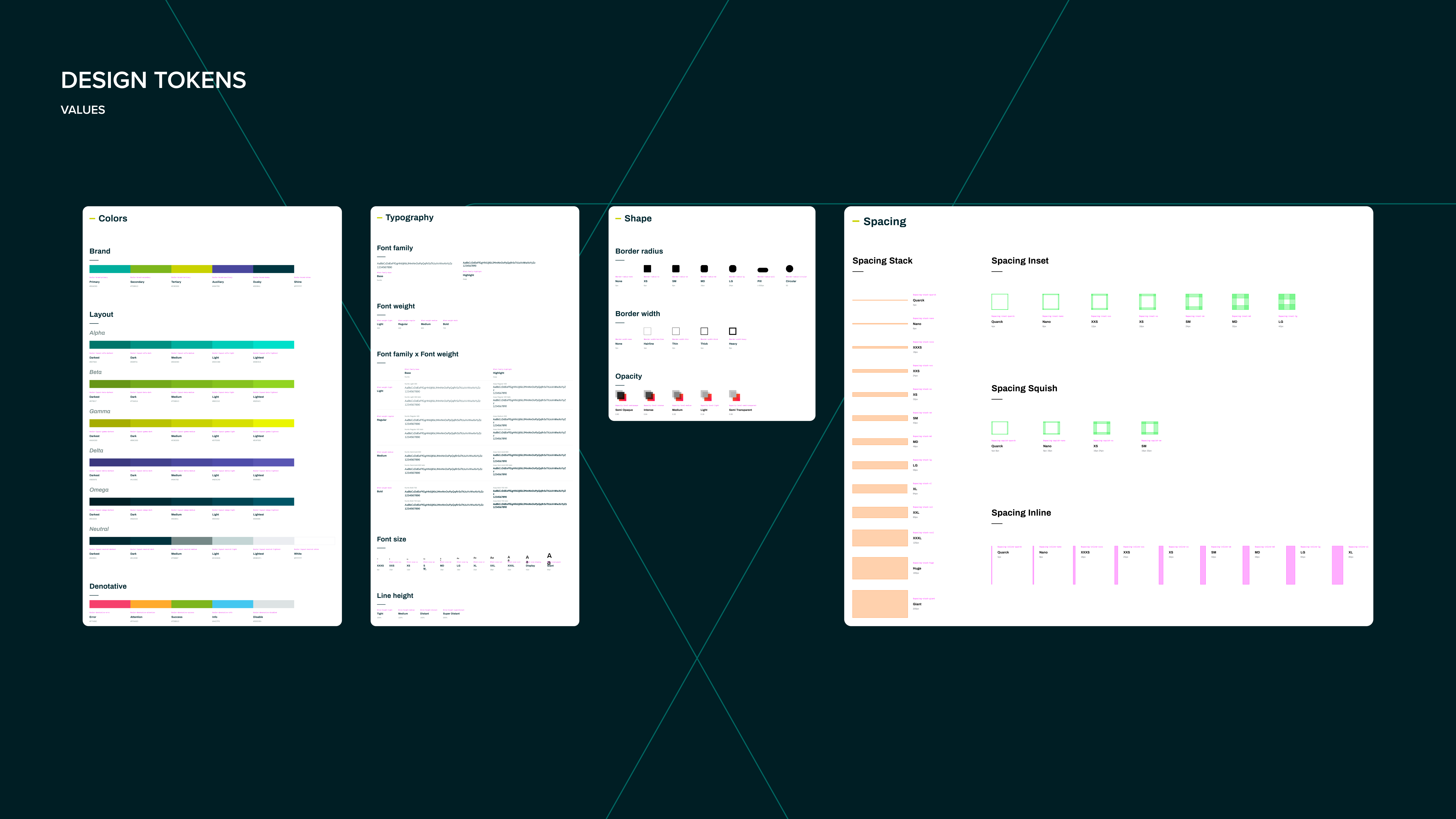

I worked as Lead on our UX chapter, focused on the design system based on Design tokens to centralize our identity for apps to keep our components as scalable as possible to our products. My current activity is working on Pix and being part of the UX GT of Open Banking Brazil.

Sisbr 3.0 was a project started by the Architecture team by other professionals, Cícero and Diogo, but we were involved from the beginning, either with UX Chapter or for its maintenance.

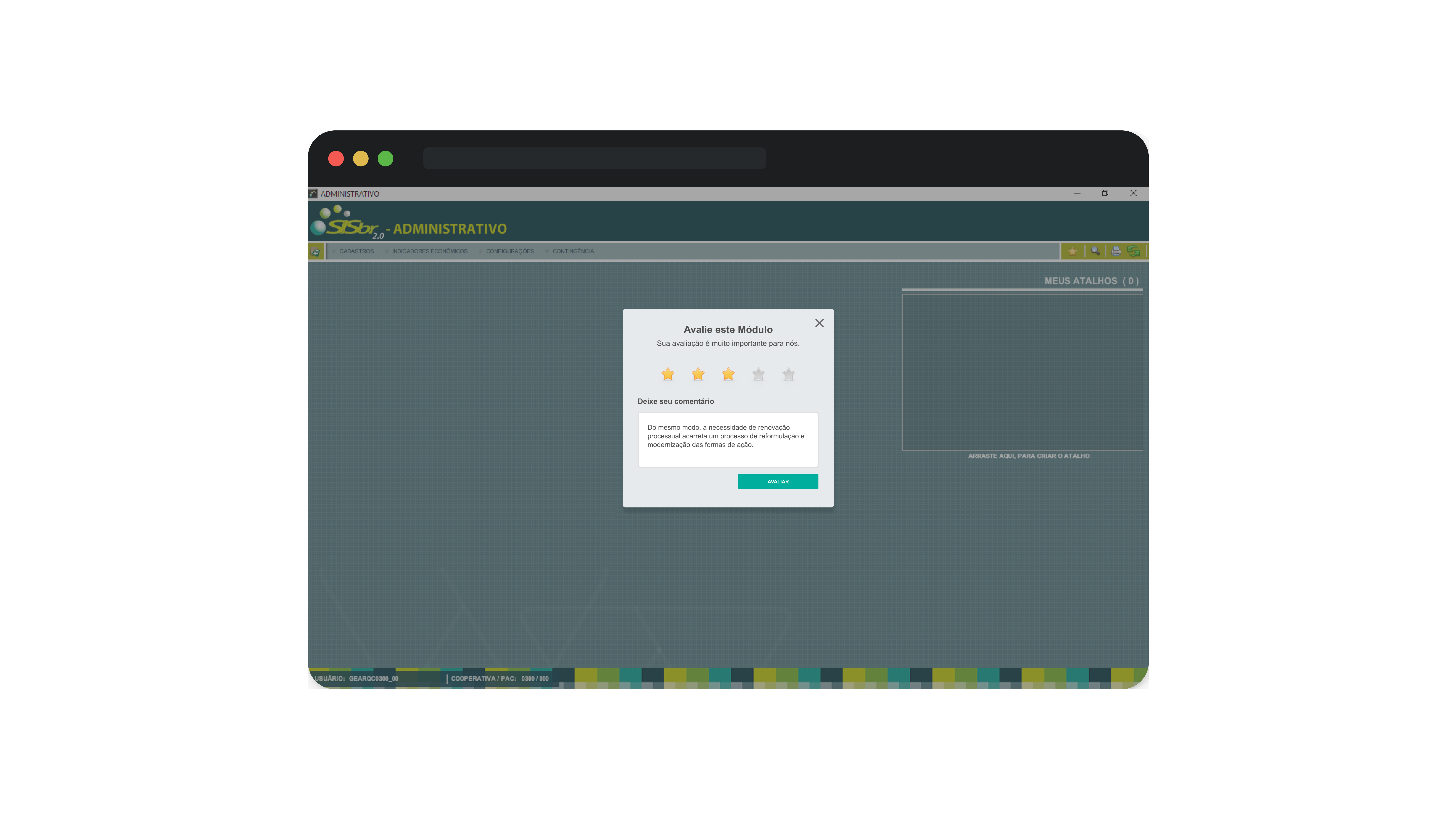

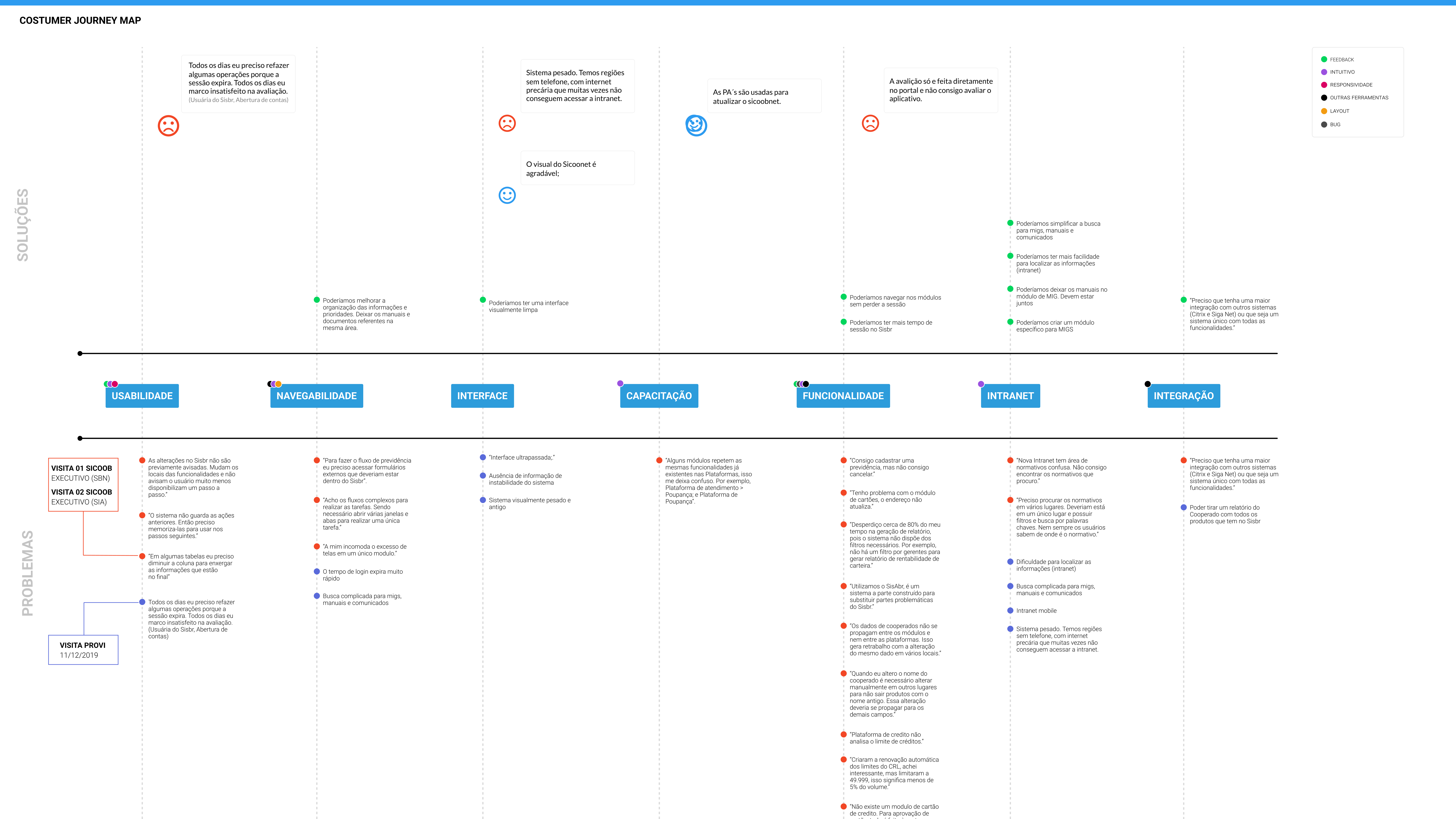

This step aims to understand the problems faced by the Sisbr user, collect suggestions and, from that, implement improvements in the new version of the system.

So far, two cooperatives in the Federal District have been visited, sending some professionals from different areas who deal with the system Sisbr in everyday life.

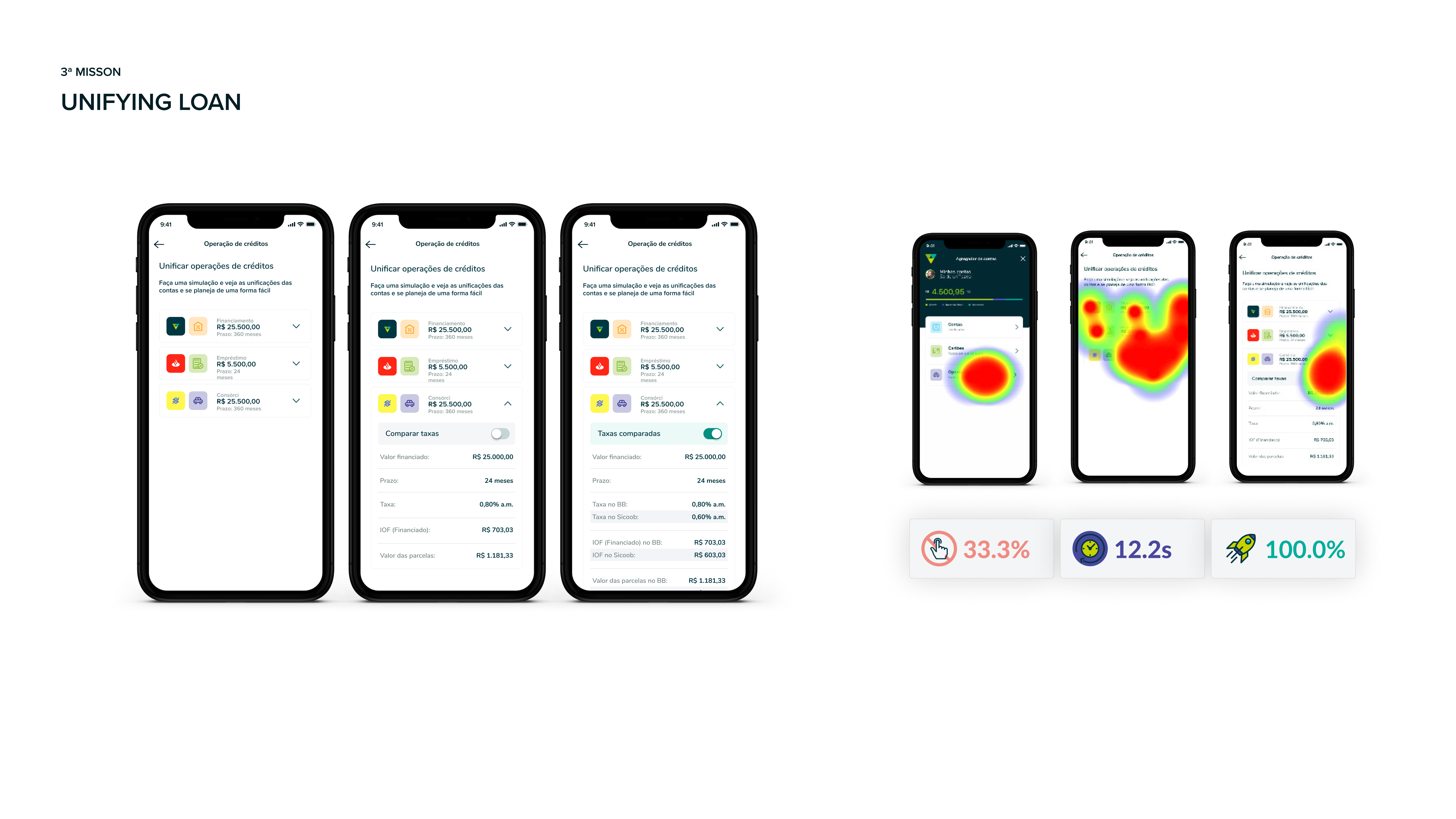

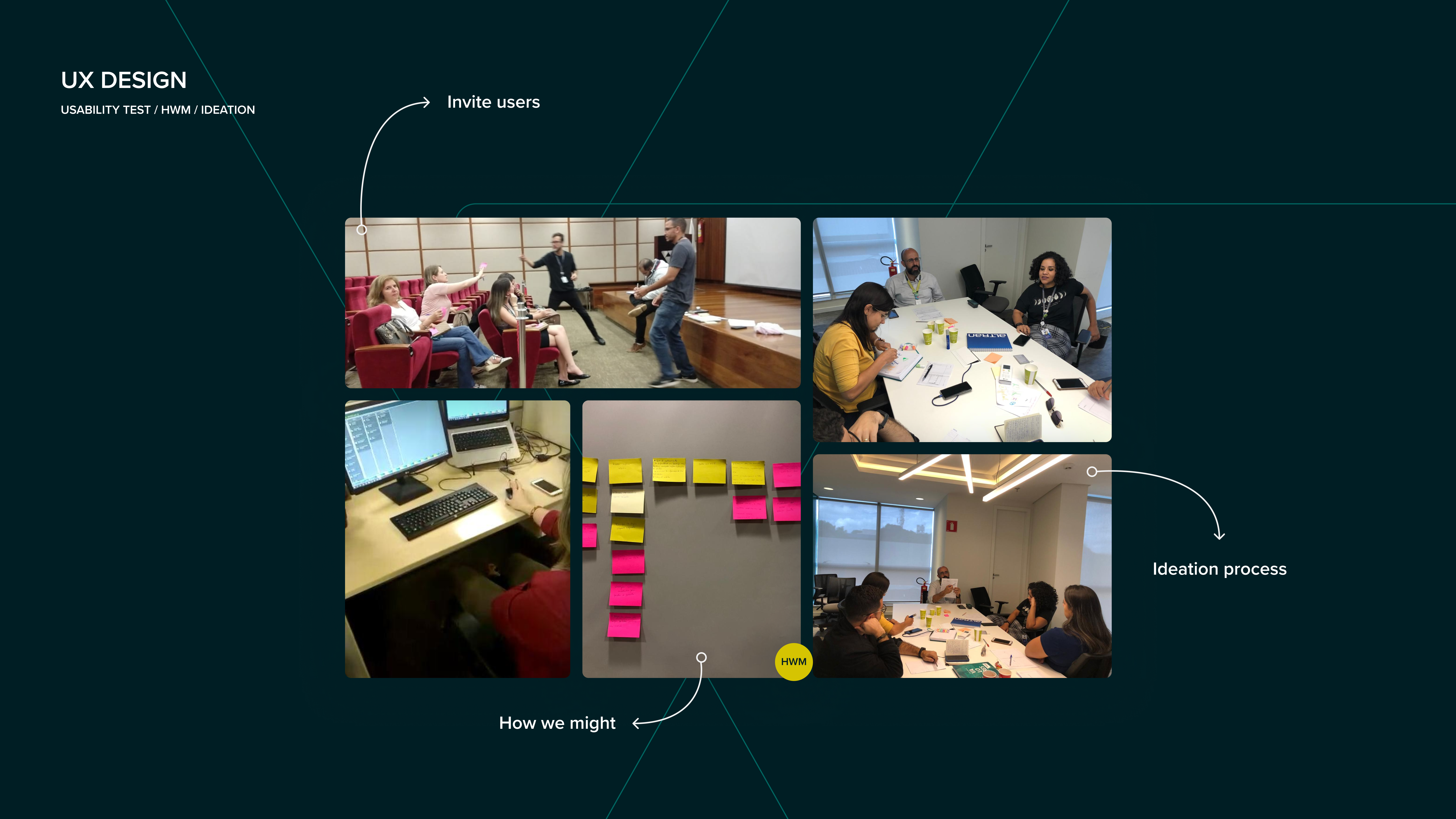

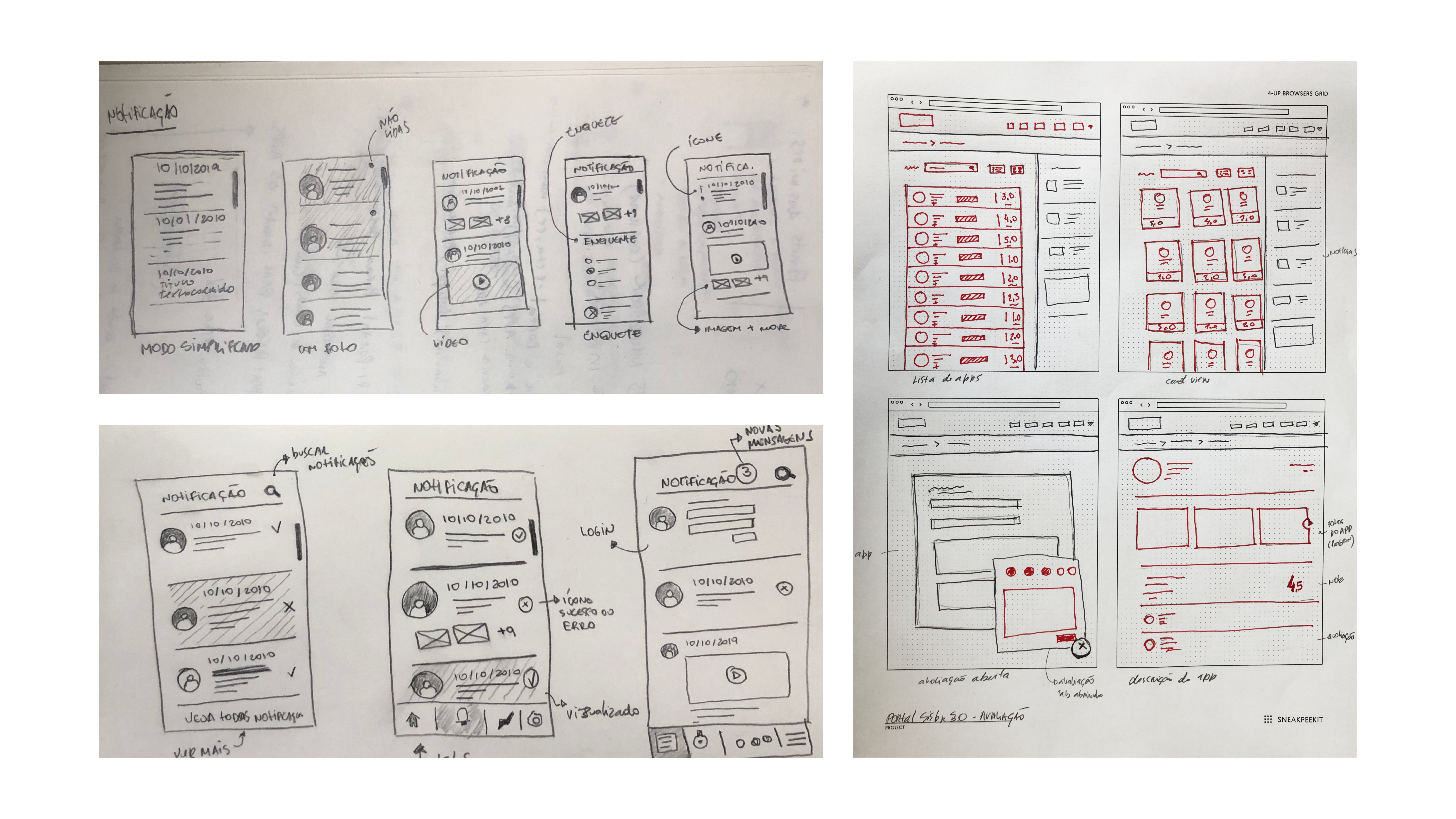

Part of my process here involved creating a store for the Sisbr 3.0 APPs, an evaluation system (included in version 2.0), designing covers and a homepage, and validating with the cooperatives through dynamics like HWM, A/B test, interviews, and ideation process.

Open finance brand made by Central Bank

Open finance brand made by Central Bank

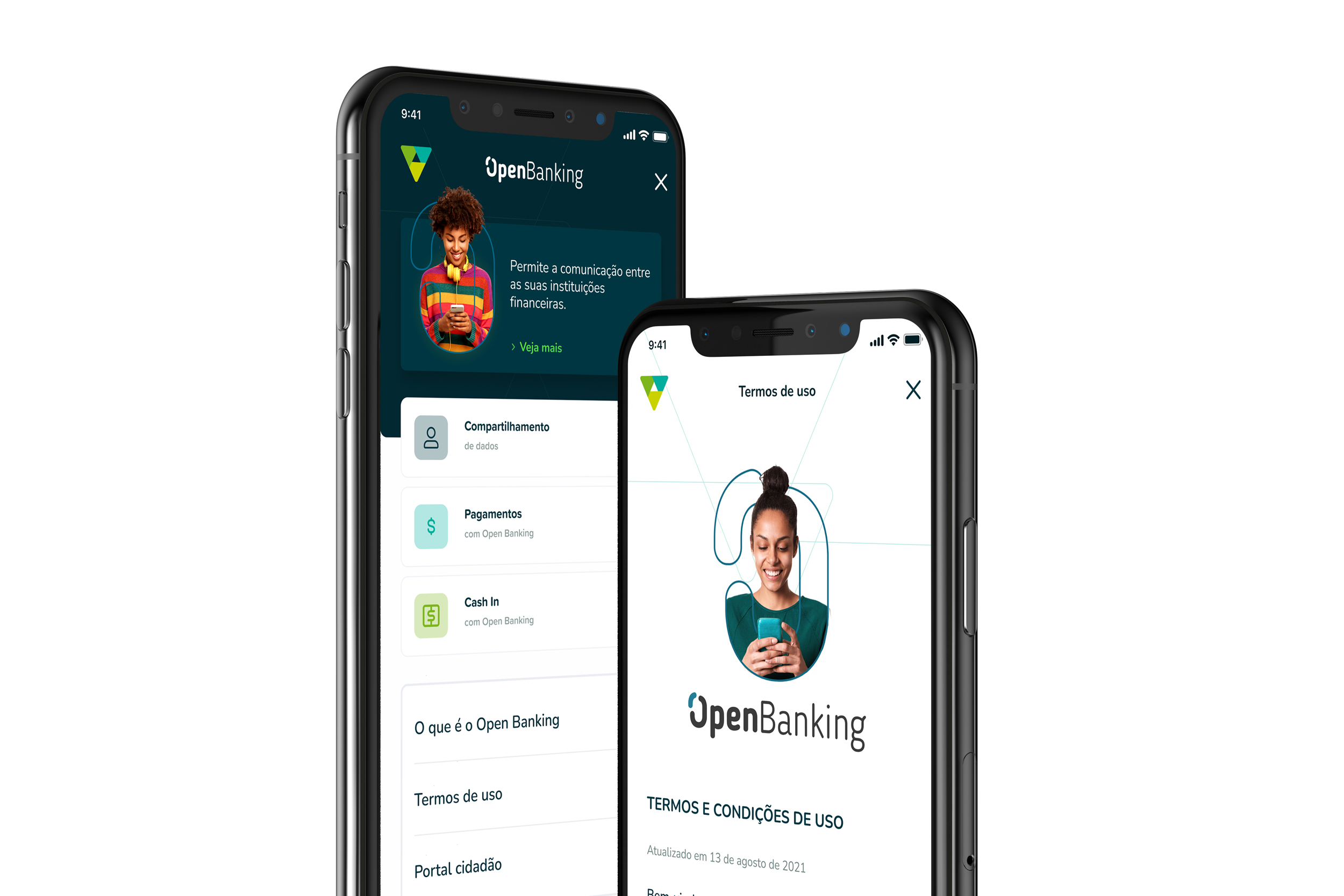

Open Banking / Finance

Open banking in Brazil refers to a regulatory framework that allows consumers to share their financial data with authorized third-party providers (TPPs) through secure application programming interfaces (APIs) provided by financial institutions. This framework is intended to increase competition, innovation, and efficiency in the financial services sector by enabling customers to access a wider range of products and services from different providers, while maintaining control over their data.

In Brazil, the implementation of open banking is being phased in gradually, starting with the sharing of customer data related to payment transactions and other basic financial services, and expanding to cover more complex financial products and services over time.

With the coming of Open Finance, there was a need to centralize design decisions across applications. Design Tokens was the first step taken to unite all applications.

With that, all applications should be created centrally, and if there were a change in some value, for example, a color, all applications would receive the changes. The Style Dictionary was essential to start testing with Design Tokens in this case.